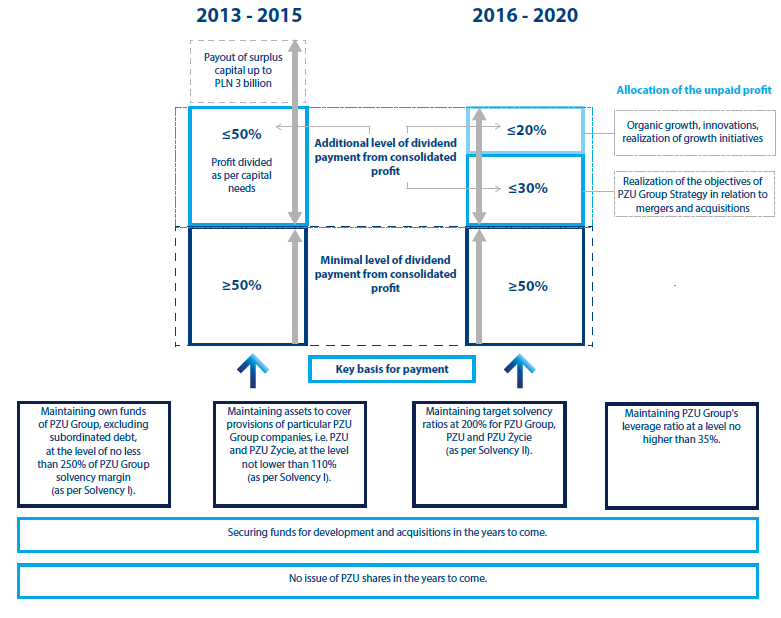

On 3 October 2016, the Supervisory Board of PZU adopted a resolution to pass the PZU Group’s capital and dividend policy for 2016–2020 („Policy”).

The introduction of the Policy was the effect of the 1 January 2016 implementation of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II), as amended, the Act on Insurance and Reinsurance Activity of 11 September 2015, and the end of the „Capital Structure and Dividend Policy of PZU Group for the years 2013–2015”, which was updated in May of 2014.

Dividend and capital policy of PZU Group

According to the Policy, PZU Group is aiming towards:

- effective capital management through optimization of capital use from the perspective of the Group;

- maximizing the rate of return for the shareholders of the parent company, especially alongside with ensuring a steady safety level and maintaining capital funds for strategic development through acquisitions;

- ensuring enough funds to cover the Group’s liabilities towards its clients.

The capital management policy is based on the following rules:

- PZU Group’s capital management (including surplus capital) at the level of PZU as the dominant entity;

- maintaining target solvency ratios at the level of 200% for PZU Group, PZU, and PZU Życie SA (in accordance with Solvency II);

- maintaining PZU Group’s leverage ratio at a level no higher than 35%;

- providing funds for development and acquisitions in the upcoming years;

- no share issues by PZU in the period of the Policy being in effect.

The capital management policy of PZU Group and PZU is based on the following rules:

- PZU Group aims to effectively manage the capital and maximize the rate of return for the shareholders of the parent company, especially alongside with ensuring a steady safety level and maintaining capital funds for strategic development through acquisitions;

- the dividend amount proposed by the Management Board of the dominating entity paid out by PZU for the given financial year is established based on the consolidated financial result of PZU Group assigned to the dominating entity, where: no more than 20% will raise the profits detained for purposes of organic development, innovation, and realization of growth initiatives (supplementary capital); *no more than 50% is subject to payout in scope of annual dividend;

- the remaining part will be paid out as annual dividend or raise detained profits (supplementary capital) if the given year includes realization of important expenditures associated with performance of the premises in PZU Group’s Strategy, specifically concerning fusion and acquisition transactions;

- with reservation of below points ;

- according to the plans of the Management Board and own evaluation of risks and solvency of the dominating entity, the own funds of the dominating entity and PZU Group following declaration or payout of the dividend remain at a level ensuring fulfillment of the conditions specified in the capital policy;

- recommendations of the authority supervising the dividend are taken into consideration for dividend determination.

Payout of dividend for 2015

On 30 June 2016, the General Shareholders’ Meeting of PZU adopted the resolution on the distribution of the net profit for the year ended 31 December 2015, in which it decided to allocate to the dividend payment the amount of PLN 1,796,127,840.00, i.e. PLN 2.08 per share.

On 30 June 2016, the General Shareholders’ Meeting of PZU adopted the resolution on the distribution of the net profit for the year ended 31 December 2015, in which it decided to allocate to the dividend payment the amount of PLN 1,796,127,840.00, i.e. PLN 2.08 per share. 30 September 2016 was chosen as the date according to which the list of shareholders entitled to the payment was established. Dividend was paid on 21 October 2016.

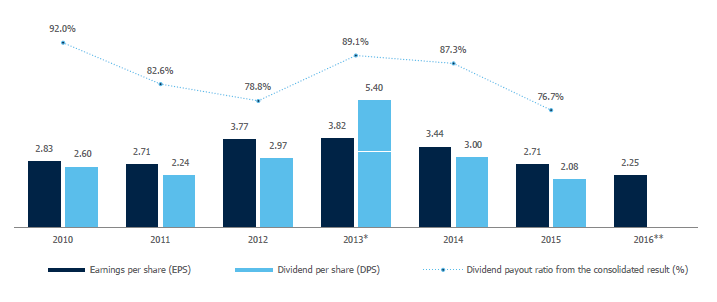

2010–2016 profit and dividend per PZU share

* dividend from surplus capitalspaid in 2013 (PLN 2.00 per share)

** By the date of preparing this Management Report of PZU Group, the Management Board had not adopted a resolution concerning distribution of profit for 2016.

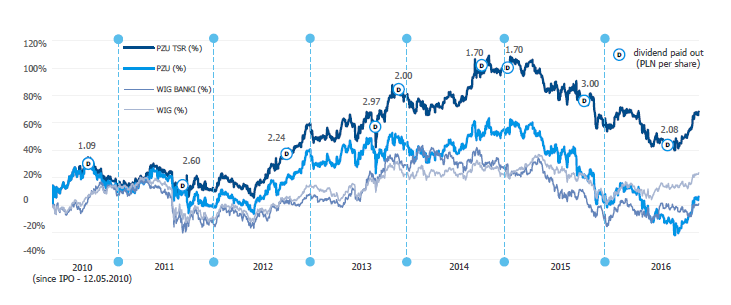

Payouts of PZU’s dividends and Total Shareholder Return - TSR (2010–2016)

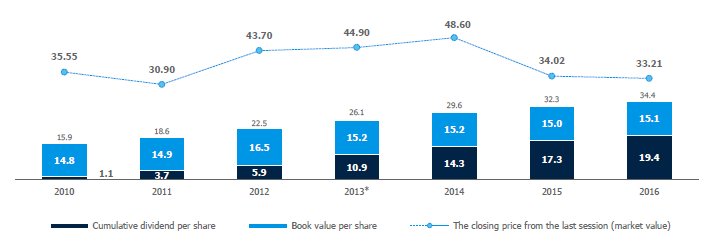

Book value per share and gross accumulated dividend per PZU share (PLN)

* dividend from surplus capital was paid in 2013 (PLN 2.00 per share)

PSFA recommendation for payout of dividend for 2016

Similarly to previous years, on 6 December, the Polish Financial Supervision Authority presented an opinion concerning the dividend policy of banks, insurance and reinsurance companies, pension funds, brokerage houses, and investment funds in 2017 (download).

As per the supervisory institution’s recommendation, the dividends should be paid only by the insurance companies that meet specific financial criteria. At the same time, the dividend payment should be limited to the maximum of 75% of the 2016 profit, maintaining the capital requirement coverage for the quarter concerning the dividend payout at minimum 110%. Simultaneously, PFSA permits dividend payment equal to the total profit of 2016 as long as the coverage of the capital requirement (after subtraction of the projected dividends from equity) at the end of 31 December 2016 and for the quarter concerning the dividend payout is at the level of minimum 175% for companies operating in section I and at least 150% for companies operating in section II.

By the date of preparing this Management Report of PZU Group, the Management Board had not adopted a resolution concerning distribution of profit for 2016.

Dividend paid by PZU from profit for 2012–2016 financial years

| 2016 | 2015 | 2014 | 2013 | 2012 | |

|---|---|---|---|---|---|

| Consolidated net profit of PZU Group (in PLN million)* | 2,417 | 2,343 | 2,968 | 3,295 | 3,254 |

| Standalone income of PZU (in PLN million) | 1,593 | 2,249 | 2,637 | 5,106 | 2,581 |

| Dividend paid per year (in PLN million) | n/a**** | 1,796 | 2,591 | 4,663 | 2,565 |

| Dividend per share per year (in PLN)* | n/a**** | 2.08 | 3.00 | 5.40** | 2.97 |

| Dividend as at the date of establishing dividend right (in PLN)** | 2.08 | 3.00 | 3.40 | 4.97 | 2.24 |

| Dividend payout ratio from the consolidated result for the year | n/a**** | 76.7 | 87.3% | 89.1%** | 78.8% |

| Dividend rate in the year (%) *** | 6.3% | 8.8% | 7.0% | 11.1% | 5.1% |

| TSR (Total Shareholders Return) | 3.7% | (23.8)% | 15.8% | 14.1% | 48.7% |

* profit attributed to the owners of the dominating company

** dividend from surplus capitals paid in 2013 (PLN 2.00 per share), not included in dividend payout ratio

*** the rate calculated as dividend as at the ex-dividend date vs. share price as at the end of the given year

**** by the date of preparing this Management Report of PZU Group, the Management Board had not adopted a resolution concerning distribution of profit for 2016