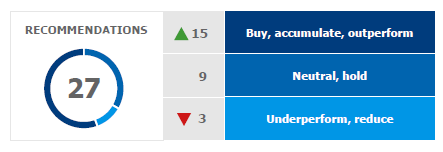

In 2016, recommendations for PZU shares were issued by 16 domestic and foreign financial institutions. In total, the sell- side analysts issued 27 recommendations. Positive (55.6%) and neutral (33.3%) recommendations formed the majority of opinions.

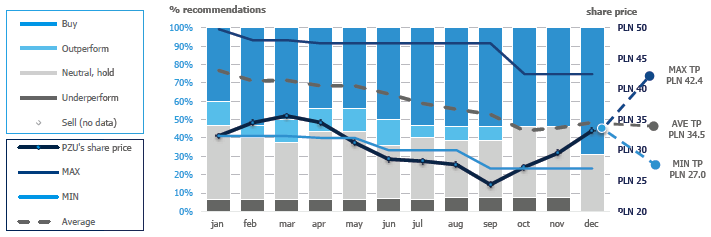

Distribution of recommendations and target prices (TP) issued in 2016

| 2016-12-31 | 2016-01-01 | change | Deviation of recommended prices from share price 2016-12-31 | |

|---|---|---|---|---|

| Maximum target price | PLN 42.4 | PLN 49.8 | -14.8% | 27.8% |

| Median target price | PLN 36.0 | PLN 43.0 | -16.3% | 8.4% |

| Average target price | PLN 34.5 | PLN 42.7 | -19.1% | 4.0% |

| Minimum target price | PLN 27.0 | PLN 35.0 | -22.9% | -18.7% |

Analysts’ expectations towards PZU share price in 2017 on the basis of recommendation updated as at the end of December 2016

The biggest impact on the assessment of PZU shares by analysts in 2016 was made by the projections and premises concerning the new strategy, dividend policy, investments in the banking sector.

The biggest impact on the assessment of PZU shares by analysts in 2016 was made by the projections and premises concerning the new strategy, dividend policy, investments in the banking sector (specifically following the personal changes in the Management Boards of PZU Group’s companies) as well as projected changes in profitability resulting from the high dynamics of tariffs on the motor insurance market, and the expectations toward investment results derived from the high volatility of capital markets.

There were 13 relevant recommendations at the end of 2016 (9 sell and 4 hold). The median of their target prices (TP) amounted to PLN 36.00 and was lower by 16.3% compared with the price median at the beginning of the year. The maximum target price was PLN 42.4 and was 14.8% lower than the maximum target price from January 2016 and, simultaneously, higher by 27.8% than the price of PZU shares at the final session of 2016.

On average, analyst recommendations in 2016 were higher by 19.7% than the PZU market assessment. This difference started to quickly diminish in the second half of the year. In October of 2016, the ratings of PZU shares exceeded the minimum recommended target price, which was associated, among others, with the positive reception of the PZU dividend policy for the years 2016–2020. The further dynamic growth of share prices raised the average analyst assessment only by 4.0% above the market assessment of PZU shares on WSE in December 2016, following the announced intention to purchase the package of shares of Bank Pekao. The spread between the highest and the lowest target prices also experienced a considerable decline, which can be interpreted as a sign of declining uncertainty. The end of the year also saw lower polarization of the given recommendations. The clearly higher uncertainty at the beginning of the year was demonstrated in the wider range of recommendations, i.e. overweight and underweight. The only recommendations left in December 2016 were to buy (69.2%) and neutral (30.8%).

Institutions issuing recommendations for PZU shares in 2016

POLAND

| Institution | Analyst | Contact details |

|---|---|---|

| Deutsche Bank | Marcin Jabłczyński | +48 22 579 87 33 |

| marcin.jablczynski@db.com | ||

| DM BH (Citi) | Andrzej Powierża | +48 22 690 35 66 |

| andrzej.powierza@citi.com | ||

| DM mBank | Michał Konarski | +48 22 697 47 37 |

| michal.konarski@mdm.pl | ||

| DM PKO BP | Jaromir Szortyka | +48 22 580 39 47 |

| jaromir.szortyka@pkobp.pl | ||

| DM Trigon | Maciej Marcinowski | maciej.marcinowski@trigon.pl |

| Haitong Bank | Kamil Stolarski | +48 22 347 40 48 |

| kstolarski@espiritosantoib.pl | ||

| Ipopema Securities | Łukasz Jańczak | +48 22 236 92 30 |

| lukasz.janczak@ipopema.pl |

INTERNATIONAL

| Institution | Analyst | Contact details |

|---|---|---|

| Credit Suisse * | Richard Burden | +44 20 7888 0499 |

| richard.burden@credit-suisse.com | ||

| ERSTE | Thomas Unger | +43 50 1001 7344 |

| thomas.unger@erstegroup.com | ||

| HSBC | Dhruv Gahlaut | +44 20 7991 6728 |

| Dhruv.gahlaut@hsbcib.com | ||

| JP Morgan | Michael Huttner | +44 20 7325 9175 |

| michael.huttner@jpmorgan.com | ||

| Raiffeisen Centrobank | Bernd Maurer | +43 1 51520 706 |

| maurer@rcb.at | ||

| Societe Generale | Jason Kalamboussis | 442 077 624 076 |

| jason.kalamboussis@sgcib.com | ||

| UBS | Michael Christelis | +27 11 322 7320 |

| michael.christelis@ubs.com |

* since June 2016