Several market segments have been distinguished to manage the PZU Group. They include corporate insurance, mass insurance, pension insurance, Ukraine and the Baltic States.

For management purposes, PZU Group has been divided into the following industry segments:

- corporate insurance (non-life) – this segment encompasses a wide range of non-life insurance, general liability and motor insurance, which are adapted to client needs and, with individually valued risks, offered by PZU, TUW PZUW and LINK4 to large business entities;

- mass insurance (non-life) – composed of non-life, accident, TPL, and motor insurance products. PZU and LINK4 provide the insurance to individuals and entities from the SME sector;

- life insurance: group and individual continued – PZU Życie offers this insurance to groups of employees and other formal groups (e.g. trade unions).

Individuals who have a legal relationship with the policyholder (for instance an employer or a trade union) may enroll in the insurance and individually continued insurance in which the policyholder acquired the right to individual continuation during the group phase. It includes the following types of insurance: protection, investment (excluding, however, investment contracts), and health insurance;

- individual life insurance – PZU Życie offers this insurance to individual clients. The insurance contract relates to a specific insured, subject to the assessment of the individual risk. This group comprises protection, investment (other than investment contracts) and health insurance products.

- investments – reported according to PAS – covering investment activity conducted with the use of PZU Group’s own funds defined as the surplus of investments over technical provisions in the PZU Group insurance companies seated in Poland increased by the surplus of investment income exceeding the risk-free rate from investments matching the value of technical and insurance provisions in the insurance products of PZU, LINK4, and PZU Życie, i.e. the surplus of investment income over income allocated to insurance segments at transfer prices of PZU, LINK4, and PZU Życie. Additionally, the investments segment includes income earned on other excess funds in PZU Group (including consolidated investment funds);

- Baltic states segment – non-life and life insurance products provided in Lithuania, Latvia, and Estonia;

- investment contracts – including PZU Życie products which do not transfer significant insurance risk and do not meet the definition of an insurance contract. They include some products with a guaranteed rate of return and some unit- linked products;

- other – this encompasses consolidated entities not allocated to any of the segments above.

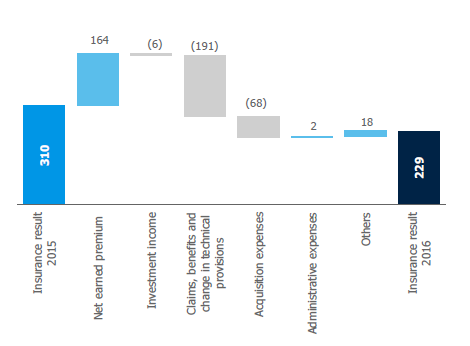

Corporate insurance

In 2016, the corporate insurance segment (composed of PZU, LINK4, and TUW PZUW) amounted the insurance result of PLN 229 million, 26.1% less than in the corresponding period of the previous year.

The following factors primarily had a key impact on this segment result in 2016:

- 11.1% growth of the net earned premium and simultaneous increase in the gross written premium by 22.2% compared with 2015, recorded mainly in:

- motor insurance resulting from the growing number of insurances and the growth of the average premium,

- group of insurance against fire and damage to property and TPL resulting from acquisition of several individually significant agreements (including TUW PZUW being joined by several major entities in the coal and energy sectors);

- 21.9% increase in insurance net claims and benefits in comparison with the corresponding period of 2015, which, considering a 11.1% increase of the net premium earned, means that the loss ratio increased by 5.7 p.p. to the level of 64.7%. The growth was recorded mainly in the group of insurance of various financial risks and general liability (submission of several major claims). Despite of a higher claims value, this effect was partially compensated with improved claims ratio in the MTPL group;

- 5.0% decline in the investment income allocated to the segment at transfer prices to PLN 115 million, which was dictated by the lower level of market interest rates partially balanced with appreciation of the exchange rate of EUR towards PLN;

- growth of acquisition expenses (not including reinsurance commissions) by PLN 73 million, i.e. by 25.3 % compared with 2015, resulting from higher direct acquisition costs is the result of considerably higher sales dynamics;

- slight drop in administrative expenses to PLN 125 million, i.e. by 1.6% from the previous year mainly as a result of limiting the expenses due to the application of cost discipline e. g. in the scope of property and marketing costs.

Insurance result in the corporate segment (PLN million)

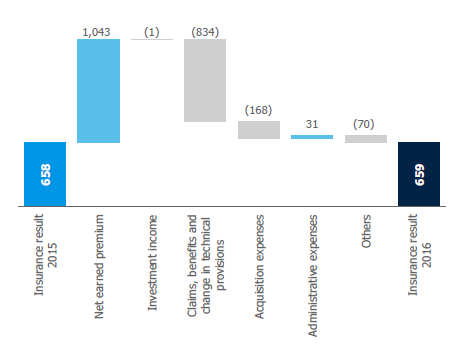

Mass client insurance

In 2016, the insurance result in the mass client insurance segment amounted to PLN 659 million, i.e. 0.2% higher than in the prior year. The individual components of the insurance result were as follows:

- 15.4% growth of the net earned premium to PLN 7,836 million with simultaneous growth of the gross written premium by 19.9% year-on-year (with the exception of the premium from the Group’s subsidiaries, +19.6% year on year) resulted mainly from the following:

- growth in motor insurance sales as the effect of increased average premium, which results from the changes to the average prices of insurance introduced gradually from the end of 2015, and a higher number of insurance offered by both PZU and LINK4.;

- upselling of additional insurance, including insurance of assistance, offered mainly in the package with motor insurance,

- increase in other tangible damage and general liability insurance, including in PZU Dom household insurance partially reduced by the lower sales of agricultural insurance (effect of strong market competition);

- growth in the value of net claims and benefits in 2016 by 18.8%, which, with the net earned premium higher by 15.4%, is reflected in the growth of the claims ratio by 1.9 p.p. compared with 2015. The change is mainly shaped by

- increase in the value of claims and benefits in crop and livestock insurances as a result of a number of claims caused by force majeure occurring in H1 2016 (claims from adverse effects of wintering were over PLN 230 million higher than the average during the last 3 years),

- increase in the level of claims and benefits in MTPL insurance resulting mainly from the increased insurance portfolio;

- investment income allocated to the mass insurance segment at transfer prices amounted to PLN 517 million,i.e. dropped year on year by 0.2%, which was dictated mainly by the lower level of market interest rates partially balanced with appreciation of the exchange rate of EUR towards PLN;

- in 2016, acquisition expenses in the mass insurance segment grew by PLN 168 million (12.1%) from the same period of the previous year and reached PLN 1,551 million. The change in acquisition costs was determined by the higher level of direct acquisition costs (including the effect of the rising insurance portfolio). Simultaneously, bank insurance recorded a drop of direct acquisition costs, which resulted from the changes in bancassurance agreement settlements with banks – from 1 April, in accordance with the requirements of the Act on Insurance Activity, the rules of remuneration for insurers concerning group agreements were changed;

- administrative expenses in this segment reached PLN 634 million, which means a drop in comparison with the previous year by 4.7% or PLN 31 million, mainly as the result of limiting expenses due to the application of cost discipline inter alia in the scope of marketing and property costs partially compensated with the change in bancassurance group contracts and as a result recognition of remuneration for administrative activities in the amount of approximately PLN 50 million.

Insurance result in the mass segment (PLN million)

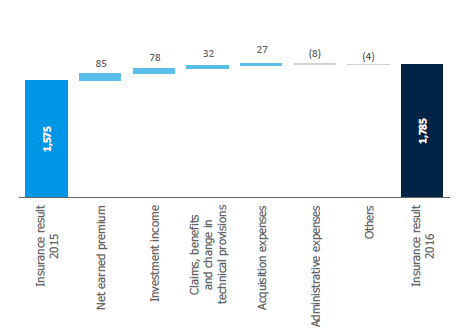

Group insurance and individually continued insurance

The insurance result in the segment of group and individually continued insurance amounted to PLN 1,785 million and was 13.3% higher than in the previous year. The individual components of the insurance result were as follows:

- growth of the gross written insurance premium by PLN 86 million (+1.3%) was primarily due to:

- development of group protection insurance (growth of the average premium and average number of additional agreements per insured person),

- acquisition of premium in group health insurance (new clients in ambulatory insurance and sales of drug product versions); PZU insures about 1.3 million clients with products of this kind,

- additional riders up-sale and rise of the insurance sum in individually continued products;

- investment income – comprising revenue allocated according to transfer prices and income from investment - type products – amounted to PLN 680 million, i.e. it increased year on year by 13%, mainly because of the higher revenue from unit-linked products (mainly EPP pension insurance) resulting from the upturn on the stock market – the WIG index rose by 11.4% compared with the 9.6% drop in the corresponding period of the previous year. The income allocated according to the transfer prices slightly declined;

- slight year-on-year changes in claims and benefits and the changes to other net technical provisions, which closed in 2016 with the amount of PLN 4,686 million (year-on-year drop by 0.7% or PLN 32 million). The change resulted mainly from the following:

- higher growth of provisions in the EPP pension insurance portfolio resulting from considerably improved 2016 investment results at stable written premium and lower paid transfers,

- lower rate of conversion of long-term contracts into annual renewable contracts in type P group. As a result, provisions of PLN 40 million were released, i.e. PLN 35 million less than in the corresponding period of 2015,

- increase in the value of health care services as the result of dynamic development of the health care products portfolio,

The factors that determine decreasing of this reporting segment are:

- as the result of the level of adjudged benefits for permanent health impairment, the assumptions concerning future payments in this area used in the calculation of provisions were verified and updated, allowing for release in 2016 provisions of PLN 216 million, mainly in continued insurance,

- lower level of compensation and benefits, mainly resulting from death and permanent health impairment in individually continued insurance;

- acquisition costs in the group and individually continued insurance segment in 2016 amounted to PLN 329 million, a PLN 27 million (7.6%) drop in comparison with the corresponding period of the previous year. Factors determining the level of direct and indirect acquisition costs included modification in the agency agreement in the bancassurance channel, due to which the presentation of remuneration for agency activities comprising of the participation in administrating the protection insurance agreements was adjusted (a transfer from the acquisition costs to the administrative expenses of the amount PLN 28 million);

- PLN 8 million (1.4%) higher administrative expenses in 2016 in comparison with the corresponding period of 2015 resulted mainly from the change in the agency agreement in the bancassurance channel and, in effect, the adjustment of the presentation of remuneration for agency activities comprising of the participation in administrating protection insurance agreements (PLN 28 million earlier included in the acquisition costs). The abovementioned negative factor has been balanced out through limiting the expenses due to the application of cost discipline inter alia in the scope of property and sales support costs.

After excluding the one-off effect related to the conversion of long-term contracts into type P renewable contracts, the segment’s 2016 insurance result amounted to PLN 1,745 million, compared with PLN 1,500 million in the corresponding period of 2015 (up by 16.3%). The simultaneous exclusion of the one-off factor of update of assumptions concerning future payments for permanent health impairment used in the calculation of provisions in individual continued insurance produced the 2016 result of PLN 1 529 million, a year on year growth of 1.9%. The main causes of improvement include rising insurance portfolio, lower claims ratio of the protection portfolio, and cost discipline.

Insurance result of the group and individually continued insurance (PLN million)

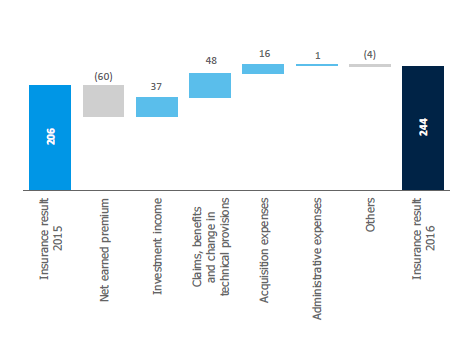

Individual insurance

In 2016, the result in insurance of the individual life insurance segment amounted to PLN 244 million, i.e. it was 18.4% higher than in the prior year. The main factors affecting the level of the segment’s profit on insurance were:

- gross written premium drop of PLN 60 million (-4.9%) from 2015 resulted from the following:

- lower value of the structured product subscriptions in own channel in comparison with 2015, which was record-breaking in this respect,

- lower average deposits to the accounts of unit-linked insurances offered through Millennium Bank,

- further decline in the deposits to the unit-linked Plan na Życie [Plan for life] product, which was withdrawn from sales in the end of 2014.

Positive results were brought by:

- higher deposits to IKE accounts, especially in Q4 2016;

- high sales of individual protection products, especially in PZU Group’s branches;

- introduction of a new unit-linked product into the own channel offer in the end of 2015: Cel na Przyszłość [Future goal];

- investment income consists of income allocated according to transfer pricing and income from investment products. In the individual insurance segment the income grew by PLN 37 million year-on-year to the amount of PLN 288 million, mainly due to the better performance recorded on IKE and the investment units in unit-linked products in the bank channel. The income allocated according to the transfer prices slightly declined;

- value of net insurance claims and benefits with change of other net technical provisions amounted to PLN 1,043 million, i.e. they dropped 4.4% in comparison with the corresponding period of 2015. This resulted mainly from the declined value of mathematical provisions in successive tranches of the individual structured product offered in PZU’s own network associated with the 2016 decline of gross written premium revenue following the record-setting previous year. Simultaneously, this effect was partially compensated with higher growth of reserves in unit-linked products like IKE and Cel na Przyszłość, which resulted from good sales results, improved investment results, and moderate level of surrenders;

- significant decline in acquisition costs in this segment (by PLN 16 million, i.e. 13.0%) resulted mainly from the modification of the remuneration system in the agency network (more even distribution over time applied to the costs of concluding the agreements), lower year-on-year sales of the new protection products agreements in this channel, and, to a lesser extent, lower sales of unit-linked insurance in the bancassurance channel;

- administrative expenses in this segment reached PLN 59 million, which means a drop in comparison with the previous year by PLN 1 million or 1.7%, mainly as a result of improved effectiveness of the agency network in terms of handling the individual products and, in addition limiting the expenses due to the application of cost discipline, inter alia in the scope of the costs of property and sales support.

Insurance result of the individual segment (PLN million)

Investments

The revenue of the investments segment constitutes of investment activity conducted with the use of PZU Group’s own funds defined as the surplus of investments over technical provisions in the PZU Group insurance companies seated in Poland (PZU, LINK4, and PZU Życie) increased by the surplus of investment income exceeding the risk-free rate from investments matching the value of technical and insurance provisions in the insurance products of PZU, Link4, and PZU Życie, i.e. the surplus of investment income of PZU, LINK4, and PZU Życie over income allocated to insurance segments at transfer prices.

Additionally, the investments segment includes income earned on other excess funds in PZU Group (including consolidated investment funds).

The operating profit of the investments segment (external operations only) amounted to PLN -570 million and was lower than in 2015 mainly due to result of Azoty Group’s share package, which was lower by PLN 479 million, and the continued low level of interest rates.

Banking sector

As at the end of December 2016, PZU, along with its subsidiaries, was in possession of 29.45% of the equity of Alior Bank. On 18 December 2015, Alior Bank was subjected to consolidation, while the banking segment constituting a part of PZU Group’s results was separated on 1 January 2016. The comparison with 2015 presented below only aims to discuss tendencies, as the result of the bank has been contributing to the result of PZU Group since the beginning of 2016.

Business activity of Alior Bank in H1 2016 faced mainly a dynamic growth of the total assets - by PLN 21.2 billion to PLN 61.2 billion (i.e. by 53% year-on-year).

The main factors generating growth of Alior Bank total assets were produced by assets, receivables from clients –y/y growth by PLN 14.8 billion (including the impact of consolidation of the results of the separated part of Bank BPH at PLN 9.2 billion) – and financial assets for sale – y/y growth by PLN 5.1 billion or 120%, and the main determinants of liabilities included client deposits – growth by PLN 17.7 billion (including the impact of consolidation of the results of the separated part of Bank BPH at PLN 12.7 billion) and capitals – growth by PLN 2.7 billion (resulting mainly from the raise of capital based on issuance of series I shares and accumulation of produced profits).

In 2016, the banking segment recorded operating profit (not including amortization of intangibles obtained with the acquisition of Alior Bank) at the level of PLN 691 million, up from 2015 by PLN 305 million. At the same time, due to the 29.45% of shares in the bank’s equity held by PZU Group, in 2016 year the banking segment contributed PLN 204 million to the result attributed to the parent entity (not including amortization of intangibles obtained with the acquisition of Alior Bank).

The result on interest is the main component of the Alior Bank group’s income, constituting 61% of said income. Its annual growth of 29.6% resulted from the organic growth of the volume of credits for clients and the accompanying growth of the client deposit base, as well as the acquisition of the separated part of Bank BPH. The adequately maintained price policy of both deposit and credit products in the conditions of the Bank’s operation in an environment of low interest rates also had positive impact on the level of generated interest revenue.

The Group’s profitability measured with net interest margin (NIM) was maintained in 2016 at the high level of 4.1% and, compared with the interest margin recorded in 2015, was lower by 50 bps. The reduced margin resulted mainly from the consolidation of the results of the separated part of Bank BPH (the consolidation covered the interest result of the separated part of Bank BPH for only the period between 4 November 2016 and 31 December 2016) and the changes in asset structure based on growth of assets available for sale in the bank’s total assets from 10.6% at the end of 2015 to 15.3% at the end of 2016.

At the same time, the average interest rate of loans grew by 0.09 p.p. to 6.11%. In the same period, the average cost of deposits decreased to 1.46%, i.e. by 0.27 p.p.

In 2016, the average WIBOR 3M rate amounted to 1.70% and was 0.4 p.p. lower than the average from 2015.

The result from impairment losses (included in the net investment result) in 2016 amounted to PLN -800 million. Therefore, the impairment losses dropped by approx. PLN 128 million in comparison with the corresponding period of the previous year and resulted mainly from the growth in the allowances for receivables from the clients of the non-financial sector.

The fee and commission result of 2016 remained almost the same as in the corresponding period of the previous year and amounted to PLN 331 million (-0.2% compared to 2015). The commission result was composed of PLN 591 million of commission income (year on year growth of 8.2%) and PLN 260 million of commission costs (y/y growth of 21.3%).

The main component of fee and commission income is commission associated with credits, accounts, transfers, deposits, payouts, loans, etc. The 2016 general administrative expenses amounted to PLN 1 567 million and were 41.4% higher, due mainly to the consolidation of the results of the separated part of Bank BPH and recognition of the restructuring provision of PLN 268 million in costs. Simultaneously, the total value of costs suffered by the separated part of Bank BPH in 2016 amounted to approximately PLN 37 million.

The cost to income ratio (C/I) amounted to 49.1% and was 2 p.p. lower than in the corresponding period of the previous year (in both excluding one-off’s events).

The financial asset tax also had considerable influence on the level of the operational profit of the banking sector. Bank tax charge in Alior Bank amounted to PLN 131 million in 2016.

Pension insurance

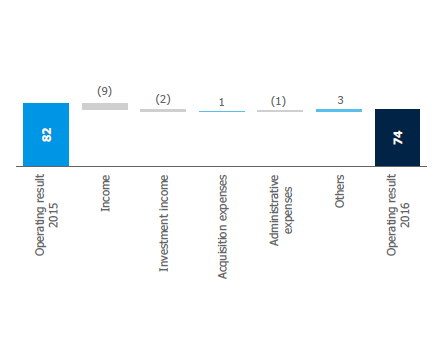

In 2016, the operating profit in the pension insurance segment amounted to PLN 74 million, i.e. it dropped by 8.7% compared with 2015. This was a result of:

- fee and commission revenue, which exceeded PLN 110 million, i.e. dropped by 6.8% from the previous year. This change was the result of:

- decrease of PLN 7 million in the management fee resulting from a decline in PZU OPF average net assets,

- decline in revenue resulting from a lower return of funds from the Guarantee Fund by PLN 2 million,

- PLN 1 million increase in revenue from due to the withdrawal of funds from the reserve account;

- net investment revenue amounted to almost PLN 5 million and was lower by PLN 2 million due to the drop in financial assets;

- acquisition and handling costs amounted to almost PLN 4 million, i.e. they were 29.7% higher than in the previous year. This resulted from the informational activity conducted by OPF in 2016;

- administrative expenses amounted to almost PLN 41 million, i.e. were 2.6% higher than in the previous year. This change mainly resulted from:

- higher payments deposited in the Guarantee Fund by PLN 5 million,

- drop in costs of provisions for sending the annual information to members of OFE PZU in 2016 by almost PLN 3 million due to the new distribution form (online account),

- drop of personnel costs resulting mainly from lower average employment and lower bonus remuneration costs.

- the operating income grew by PLN 3 million due to the collection of the motivational fee (PLN 2 million), revaluation of the provision for return of fees from premiums overpaid by ZUS (almost PLN 1 million), and release of provisions for sending the annual fund information for 2015 (PLN 1 million);

- other operating costs dropped by over PLN 2 million due to the revaluation of the provision for the return of fees from premiums overpaid by ZUS.

Operating profit in the pension insurance segment (PLN million)

Baltic states

Up to 30 September 2015, the Baltic states segment’s results included PZU Lithuania, which has considerable effect on the comparability of the 2015–2016 financial information.

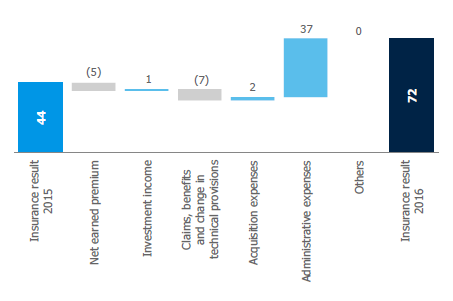

PZU Group generated a positive result on insurance in the amount of PLN 72 million in the Baltic states in 2016 compared with PLN 44 million in the previous year. This result was determined by the following factors:

- drop in gross written premium. It amounted to PLN 1,183 million compared with PLN 1,193 million in the previous year, and the 2015 premium collected by PZU Lithuania reached PLN 231 million. Excluding the contribution of PZU Lithuania, the non-life insurance premium grew year- on-year by PLN 146 million (i.e. 14.8%). This dynamic premium growth was made possible by the higher motor insurance rates in the region, increased property insurance premium especially in Lithuania where the company activated sales, and considerable growth of the written health insurance premium in Latvia. The life insurance premium rose by PLN 8 million (i.e. 19.5%);

- higher investment income. In 2016, the result amounted to PLN 23 million, up by 4.5% from the previous year;

- increase in net claims and benefits. They amounted to PLN 694 million and were PLN 7 million higher than in the previous year – the value of claims and benefits of PZU Lithuania in the previous year amounted to PLN 149 million. The non-life insurance claims ratio reached the level of 62.0%, up by 0.4 p.p. from the previous year. It was, inter alia, due to the increase in large losses and higher rate of losses (resulting mainly from unfavorable weather conditions in winter of 2016). In life insurance, the value of benefits amounted to PLN 41 million, 40.1% higher than in the previous year due to higher provisions on client risk;

- drop in acquisition costs. The segments expenses for this purpose amounted to PLN 251 million. The acquisition cost ratio from the net earned premium dropped by 0.1 p.p. to 22.7%. Following the elimination of the contribution of PZU Lithuania in 2015 (PLN 48 million), the acquisition costs rose year-on-year by 22.5%, i.e. at a level similar to the growth of the gross written premium;

- decrease in administrative expenses. They amounted to PLN 110 million, down by 25.2% from the previous year – the total administrative expenses of PZU Lithuania in 2015 amounted to PLN 30 million. The dropping costs were accompanied by reduction of the administrative expenses indicator, which amounted to 10.0%, a drop of 3.3 p.p. from 2015. Without the contribution of PZU Lithuania, the declined costs in the Baltic states segment was still visible at 6.4% year-on-year (with simultaneous drop of the indicator by 0.6 p.p.). Lowering of administrative expenses was possible due to maintaining cost discipline, mainly in the IT area.

Insurance result of the Baltic states segment (PLN million)

Ukraine

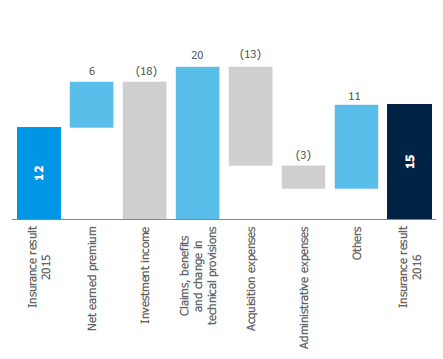

In 2016, the Ukraine segment closed the year with a positive result on insurance at PLN 15 million, compared with PLN 12 million in the previous year.

The change in the segment’s result was determined by:

- increase in the gross written premium. The premium amounted to PLN 210 million and increased by PLN 41 million (i.e. 24.3%) in comparison with the previous year. The growth of the non-life insurance premium (25.4% year-on-year) was experienced mainly in property insurance due to establishment of a new contract with a major corporate client and in motor insurance due to the raise of insurance sums and raise of mandatory insurance rates. The life insurance premium rose by PLN 6 million (i.e. 19.4%);

- lower revenue from investing activities. This segment earned PLN 23 million in this respect, 43.9% less than in 2015, which was caused by the positive currency rate differences in the portfolio of investments denominated in USD that were recognized in investment revenues in the previous year;

- decrease in net claims and benefits. They amounted to PLN 54 million, i.e. 27.0% lower than in the previous year. Meanwhile, the drop was related mainly to the lower benefit payments in the life insurance company, which amounted to PLN 21 million, a drop of 48.9% from 2015. The claims ratio from the net earned premium slightly rose in non-life insurance (by 0.2 p.p.) to 45.1%;

- increase in acquisition costs. They amounted to PLN 60 million compared with PLN 47 million in the prior year. The level of growth resulted from the growth in the written premium;

- increase in administrative expenses. They amounted to PLN 24 million. For comparison purposes – in 2015, the administrative expenses of the segment amounted to PLN 21 million. Their increase was related, inter alia, to indexation of remuneration, UAH devaluation, and inflation. The administrative expenses ratio from the net earned premium rose by 1.6 p.p. to 22.0%.

Insurance result of the Ukraine segment (PLN million)

Investment contracts

The consolidated statements present the investment contracts are in accordance with the requirements of IAS 39.

The results of investment contracts segment are presented as per the Polish Accounting Standards, which means that the following items were included: gross written premiums, paid benefits, and change in technical provisions, among others. The above categories have been eliminated for the purpose of the consolidated results.

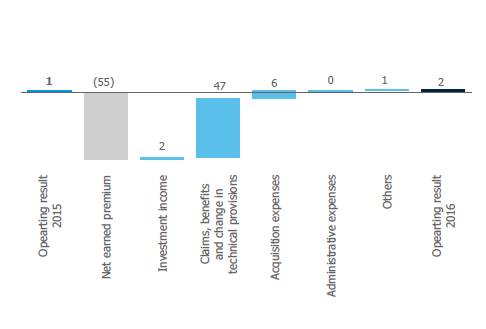

PZU Group earned PLN 2 million of operating result compared with PLN 1 million in the previous year (increase of 100%) on investment contracts, i.e. PZU Życie’s products which do not transfer significant insurance risk and which do not meet the definition of an insurance contract (such as some products with a guaranteed rate of return and some unit-linked products).

The following had impact on the results of investment contracts segment in 2016:

- gross written premium from investment contracts dropped by PLN 55 million (-39.0%) from the corresponding period of 2015 to PLN 86 million. The main reasons for the changes in the gross written premium included the removal of the short-term life and endowment products from the offer starting with June 2016;

- improved investment income. It amounted to PLN 18 million, i.e. was 12.5% higher than in the corresponding period of 2015, mainly due to improved interest rates in IKZE and funds in the unit-linked products in the bancassurance channel balanced with a lower level of investments in short-term life and endowment products; simultaneously, the declined unit-linked product assets had negative impact on the reduction of the management fee also covered in this reported item;

- PLN 47 million lower value of net insurance claims and benefits and change of other net technical provisions resulting from the considerable drop in payments from gross written premium in short-term life and endowment products in own channel resulting from withdrawal of the product from the offer with June of 2016 (no significant effect on the result – corresponding effect in revenue). These amounted to PLN 89 million, i.e. they were 34.6% lower than in the prior year;

- lower acquisition costs. These amounted to PLN 4 million, i.e. they were 60.0% lower than in the prior year. This resulted from the lack of new sales and declined asset value in unit-linked products of the bancassurance channel (some of the bank’s remuneration is determined by the level of assets), and, additionally, from the lower engagement of the own network in sales of short-term investment endowments as well as, beginning in June, the withdrawal of the products of this type from the offer;

- no changes in administrative expenses. Similarly to 2015, they closed at PLN 9 million.

Operating profit of investment contracts segment (PLN million)

Profitability ratios

In 2016, the return on equity of the dominating entity (PZU) was 15.0%. ROE was 3.0 p.p. lower than in the previous year. The profitability ratios achieved in 2016 by PZU Group exceed the levels achieved by the whole market (according to the data for three quarters of 2016).

| Key profitability ratios of PZU Group | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|

| Return on Equity (ROE) – falling to the dominating entity (annualized net profit / average equity) x 100% |

15.0% | 18.0% | 22.6% | 24.1% | 24.1% |

| Return on Equity (ROE) – consolidated (annualized net profit / average equity) x 100% |

15.0% | 16.6% | 22.6% | 24.1% | 24.0% |

| Return on Assets (ROA) (annualized net profit / average assets) x 100% |

2.1% | 2.7% | 4.6% | 5.6% | 6.0% |

| Rentowność sprzedaży (net revenue / gross written premium) x100% |

12.0% | 12.8% | 17.6% | 20.0% | 20.0% |

Operating efficiency ratios

One of the basic efficiency and operating measure of an insurance company is the combined ratio (COR) which is calculated for the non-life sector because of its specific nature. The combined ratio of PZU Group (for non-life insurance) remains in the last few years at a level which guarantees high profitability. In 2016, the ratio grew mainly due to the with higher claims ratio in agricultural insurance resulting from numerous damages caused by forces of nature (adverse effects of wintering).

| Operating efficiency ratios | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|

| 1. Claims ratio gross (Gross claims /gross written premium) x 100% |

63.7% | 66.9% | 69.5% | 67.9% | 76.2% |

| 2. Claims ratio net of reinsurance (net claims paid/net premium earned) × 100% |

68.4% | 68.2% | 70.3% | 68.7% | 76.3% |

| 3. Insurance activity costs ratio in insurance segments (Costs of insurance activity/premium earned net of reinsurance) x 100% |

22.5% | 23.3% | 22.2% | 20.5% | 21.0% |

| 4. Acquisition costs ratio in insurance segments (Acquisition expenses/premium earned net of reinsurance) x 100% |

14.3% | 14.1% | 13.4% | 12.3% | 12.1% |

| 5. Administrative expenses ratio in insurance segments (Administrative expenses/premium earned net of reinsurance) x 100% |

8.3% | 9.2% | 8.8% | 8.1% | 8.9% |

| 6. Combined ratio in non-life insurance (claims + costs of insurance activity/premium earned net of reinsurance) x 100% |

94.9% | 94.5% | 95.7% | 87.8% | 92.8% |

| 7. Operating profit margin in life insurance (operating profit/gross written premium) x 100% |

25.3% | 22.3% | 24.4% | 22.3% | 19.8% |