Sales channels

The organization of the PZU sales network guarantees sales effectiveness, while simultaneously assuring high quality of the provided services. PZU Group has the largest network of sales and service branches on the Polish market.

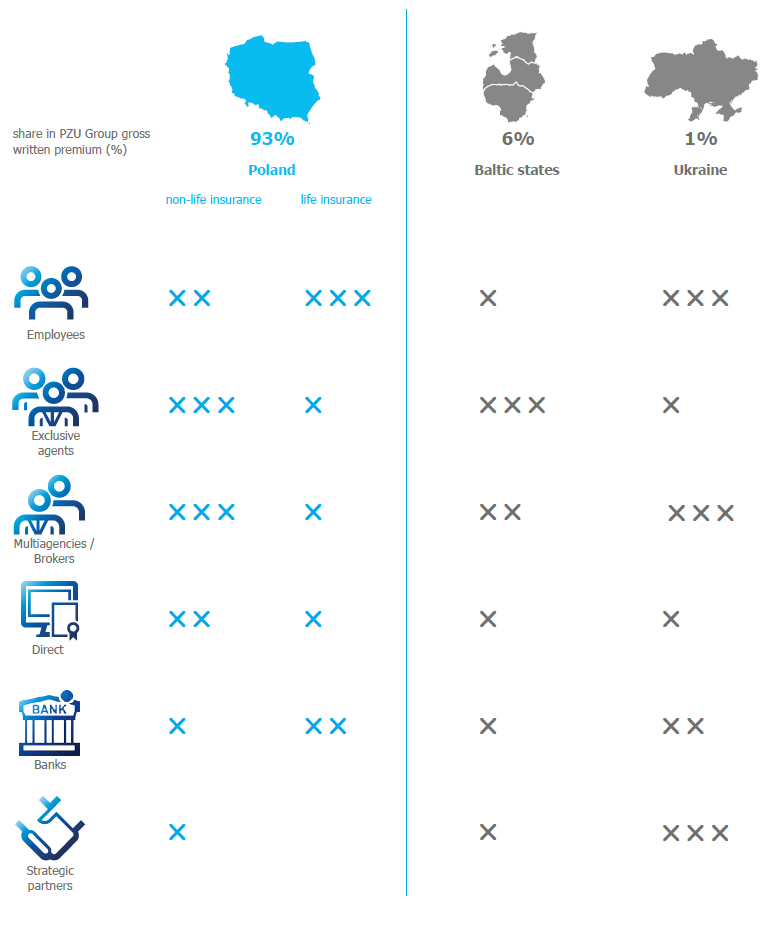

At the end of 2016, PZU Group distribution network cooperated with 8,758 exclusive agents, 3,232 multiagencies, about 1,100 insurance brokers, 15 banks and 17 strategic partners.

At the end of 2016, PZU Group distribution network included:

- exclusive agents – PZU’s own agency network in Poland consisted of 8,758 exclusive agents, including natural persons performing agency activities. The agency channel conducts sales mainly in the mass client insurance segment, especially motor and non-life insurance, as well as individual insurance (life insurance). The Group’s agency network was composed of approximately 1,100 agents in the Baltic states (PZU Group operates on the non-life insurance market of Lithuania, Latvia and Estonia through, appropriately, Lietuvos Draudiamas, AAS Balta, and PZU Estonia branch of Lietuvos Draudimas, and on the life insurance market through Lietuva GD) and almost 700 agents in Ukraine (where PZU operates on both the non-life and life insurance markets through, appropriately, PZU Ukraine and PZU Ukraine Life).

- multiagencies – 3,232 multiagencies work with PZU Group on the Polish insurance market to make sales mainly to the mass client (this channel is used to sell all types of insurance, especially motor insurance and non-life insurance) as well as individual life insurance. The Group’s companies cooperate with 2 multiagencies in the Baltic states and 10 multiagencies in Ukraine.

- insurance brokers – PZU, in particular the Corporate Customer Division, cooperated with about 1,100 insurance brokers in Poland. The Group’s companies worked with over 300 brokers in the Baltic states, where the broker channel is one of the main insurance distribution channels, and with approximately 40 brokers in Ukraine.

- bancassurance and strategic partnership programs – PZU Group cooperated with 15 banks and 17 strategic partners in Poland in scope of protective insurance in 2016. The partners of PZU Group are the leaders in their fields and have customer bases with great potential. The cooperation in the scope of strategic partnerships concerned mainly the companies operating in telecommunications and energy, which were used to offer insurance of electronic equipment and assistance services. In Baltic states, PZU cooperated with 3 banks and 14 strategic partners. It ao cooperated with 6 banks and 3 strategic partners in Ukraine.

Scale from 1 to 3, where 3 means the highest share in gross written premium.

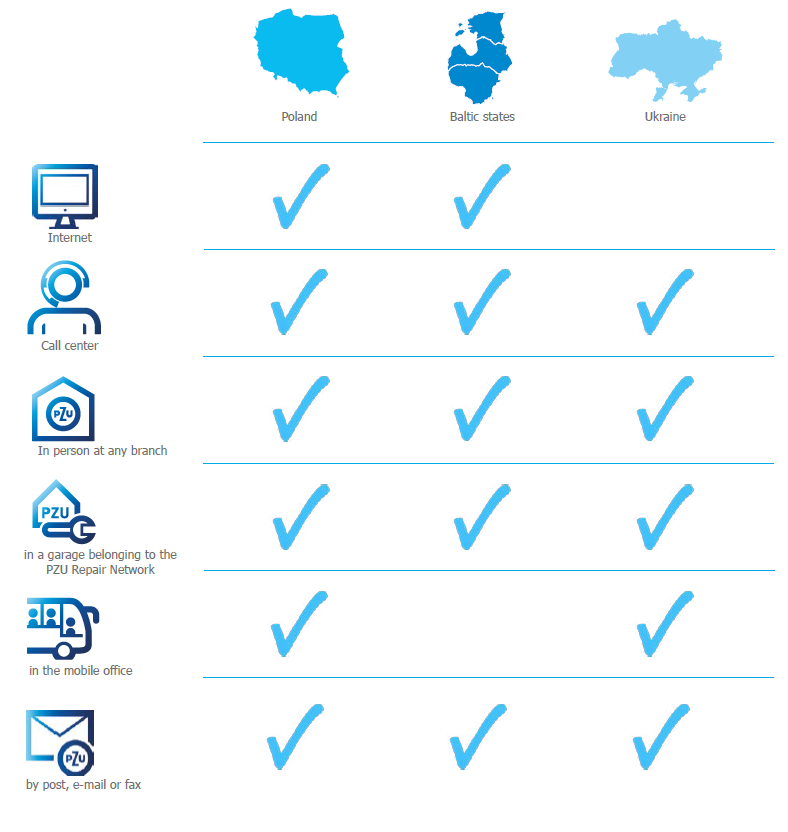

How to report the claim?

Claims handling

For the customer, claims handling process is the moment of truth in contacts with the insurer and an opportunity to test the quality of the purchased product. Satisfying his or her expectations in the claims/issue handling process is the key to building client ties with PZU. Because of this, PZU Group took numerous activities in 2016 to improve and shorten the process.

In Poland, claims and benefits are handled in 6 competence centers, which operate nationwide. This is based mainly on electronic information and is not connected with the place of residence of the insured or the place of the event. Competence centers handle certain types of claims; this results in higher specialization level and boosts customer satisfaction. Such units specialize, among others, in handling of motor, property and personal claims, corporate client claims, benefits, claims consisting in a complete theft of vehicles belonging to natural persons, and claims under the BLS service (direct claims handling). A separate entity provides technical support for motor and property claims. There is a similar claims handling model in PZU Estonia, where there are 3 competence centers. Only handling of specific claims like bodily injury claims, major property claims, and marine claims is centralized. The claims handling process in the remaining Group’s companies operating in the Baltic states and Ukraine is fully centralized.

In 2014, PZU became a BLS pioneer on the Polish insurance market. At present, the Company realizes it in the two following forms: individually and under an agreement. By the end of 2016, the BLS agreement drafted by PIU encompassed eight insurance companies, including PZU. Together, they represent nearly 70% of the motor TPL insurance market measured at gross written premium level. The agreement introduced in April 2015, which bases on lump-sum schemes, considerably simplified the settlement of paid claims between the insurers. PZU also maintained its earlier BLS solution for its clients who suffered damage at the hands of the people insured at insurance companies that didn’t join the agreement. PZU was also a BLS pioneer on the Ukrainian market. PZU Ukraine made the first such payout in December 2016. The BLS agreement drafted by the Ukrainian motor office now covers 17 insurance companies. Together, they represent nearly 80% of the TPL insurance market measured at gross written premium level. In Estonia, direct claims handling is regulated by the act on TPL insurance from early 2015. In Latvia, a client who wants to take advantage of direct claims handling must purchase an insurance supplement.

PZU created the largest network of companies on the Polish market that provide car rental, towing, and parking services.

PZU created the largest network of companies on the Polish market that provide car rental, towing, and parking services. From 2015, Lietuvos Drauidmas is the only insurer in Lithuania providing such services to both motor own damage and motor TPL insurance holders. PZU was the first to introduce its own fleet of replacement cars to the Polish insurance market. The offer covers 300 hybrid Toyota Auris cars, which guarantee comfort and safe and ecological use. This provides a high replacement car availability standard according to market rates to all PZU clients.

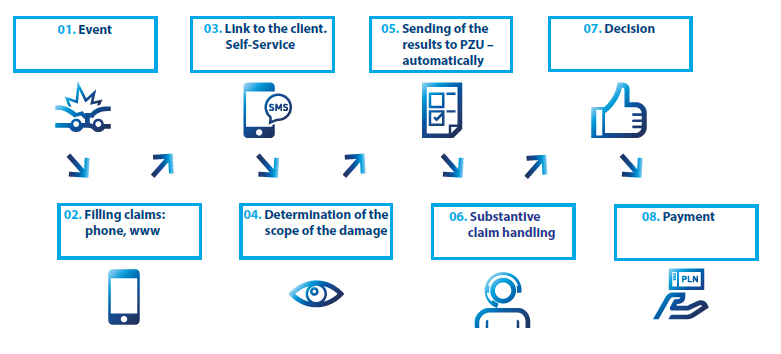

Self-service claim process

In 2016, PZU Group continued cooperation with garages in the field of post-accident vehicle repairs in countries where operates. Every client who commissions a vehicle repair at a PZU Pomoc garage in Poland receives a Quality Certificate confirming that the repair met high quality standards. PZU continues to develop its offer when it comes to the management of objects that are left after a damage that can be sold on the Pomoc Online platform. The clients receive an offer to sell the remains for the highest obtained purchase offer from credible entities, who are permanently working with the platform administrator (a similar solution is available for the clients of PZU Estonia).

Self-service claim process

In addition, PZU is implementing claim self-service, which is activated personally by the client with the link received via text message or email. In case of accident claims or benefits, the client accepts or rejects the proposed amount of the benefit. In motor and property claims as well as at workshops that repair equipment damaged during overload, the client – prior to deciding – can estimate the amount of compensation on his/her own in several steps. The information is sent online to the Issue Consultant, who realizes the payment. The service allows easy and convenient participation in the decision- making process concerning the payment, and speeds up the entire process, thus shortening the period of waiting for money. Client satisfaction surveys conducted among the PZU Życie clients show that the insured perceive the service in a very positive way. In 2016, over 30% of the clients whose issues qualified for this form of service decided to use it. PZU’s companies in the Baltic states are introducing similar improvements.

In 2016, PZU introduced a number of simplified solutions to contact the clients, e.g. it resigned from traditional letters, popularized contact over the telephone and electronic means of communication, but first and foremost it made its correspondence simpler and more user-friendly.

Visual representation of claims handling stages in the Online Claim/Issue Status – available for the Group’s clients in Poland is also very helpful tool for the clients. After logging to his or her claim/issue at www.pzu.pl, the client can learn how many stages the PZU customer service process involves, become familiar with every stage, and check his or her claim/ issue status, as well as see which activities have already been realized. Moreover, the www.pzu.pl website features also a video with tips related to online claims handling. Short videos depict PZU employees showing the clients how to quickly file a claim, change its status, or how to use the accident insurance in case of an accident. PZU – Video tips – Online claims handling.

Another innovative move that supports the process of personal claims handling from TPL insurance was to appoint the Assistance Providers under the name of Organizatorzy Pomocy Poszkodowanym w Wypadkach [Providers of Assistance to Accident Victims]. These are mobile employees who meet with the victims in their houses in Poland and determine the actual life situation and the needs related to the accident they suffered from and for which PZU is liable. Assistance Providers shall explain to accident victims their laws and tell them which documents they have to present. For people who have suffered serious damage, they shall organize broadly defined medical, social and vocational rehabilitation. They advise on how to adjust place of residence to meet the needs of a disabled person, as well as how to choose proper systems compensating for dysfunctions and disabilities. They assist in obtaining the benefits from governmental institutions (from PFRON [National Disabled Persons Rehabilitation Fund], ZUS [Social Insurance Institution], KRUS [Farmer’s Social Security Fund], MOPS [Municipal Social Services Centre], and MOPR [Municipal Family Support Centre]).

Another innovation which is being developed by PZU is the creation of a system for crops claims handling by using aerial and satellite photographs. It is significantly important in a situation in which a larger number of crops damages occur in a short period of time. With this solution PZU will shorten the process during which the clients are waiting for decision concerning the claim.

An important area of activity within the processes of claims and benefits handling is prevention of insurance frauds. PZU continues to improve solutions limiting payments of unduly benefits and impeding practices of clients providing both false documentation during reporting the claim and untrue declarations concerning their health, as well as simplifying many processes.

Innovations

In recent years, PZU has been intensively working on implementing innovative solutions to improve the customer experience as much as possible. This objective is supported by the Laboratory of Innovation, which was established at the end of 2013. The Laboratory of Innovation is currently working on implementing an innovation strategy for all of PZU Group, which covers building a culture of innovation and cooperation with other Group’s companies, including LINK4, Alior Bank and foreign insurance companies.

One of the Group’s biggest innovative operations is the PZU Everest Platform. This is the biggest IT project in the CEE region and the Group’s biggest business transformation. The Platform is a state-of-the-art tool that facilitates sales of non-life insurance, assessment of insurance risk, and management of policies and settlement, which PZU has been implementing since 2014. The implementation of the Everest platform in all channels will end in Q1 2017. The platform lets the Group distribute information faster and, consequentially, allows the agents to better recognize and understand the needs of clients from different sectors. As it improves and modernizes the working environment of the Group’s agents and employees (reduction of paper consumption by 70% from before implementation), the Everest platform helps raise operating efficiency, which additionally expands the potential for presenting a competitive offer to the clients.

Last year, over 13 thousand agents were implemented following pilot tests in external distribution channels (multiagents, dealers). The Everest platform was implemented also in the bancassurance channel and corporate client segment.

“Innovation distinguishes between a leader and a follower” Steve Jobs, founder of APPLE

The expansion of the product offer made available to the agents continued under the framework of the Everest platform development – in 2016 new and enhanced products were introduced, addressing the needs of corporate segment clients and small and medium-sized enterprises. The final quarter of 2016 the transfer of sales realized through offline channels to the platform was made (including motor and non-life leasing, bancassurance, and financial insurance).

PZU Group continues to work on more innovations and started the development of the PZU GO Self Service platform for the individual client at the end of 2016. The platform will provide online access to the products and services (purchase of insurance, medical services, and investment or savings products) offered by all of the Group’s companies and to their features in the future (filing claims, making doctor’s appointments, checking investment funds quotation or other entities, or paying premiums). Meanwhile, the Group will have aggregated information about its clients and will be able to distribute information and identify individual needs quicker.

In turn, last year, LINK4 introduced a solution promoting safe driving and eco driving for individual clients and mini fleets. Thanks to the established cooperation with a distributor of GPS navigation in mobile phones, the company adds a one-year license for the navigation system and its section, „Safe Driving with Link4”, to the purchased policy (during the promotional period).

Benefits of the Everest Platform launching