2016 was another year of dynamic changes in the situation on financial markets.

The first weeks of 2016 were very bad for the stock market, especially in Europe. Polish stock indices compared to Europe rather favourably, although WIG and WIG20 also registered losses. The declines on the Polish stock market resulted mainly from the situation on the global markets.

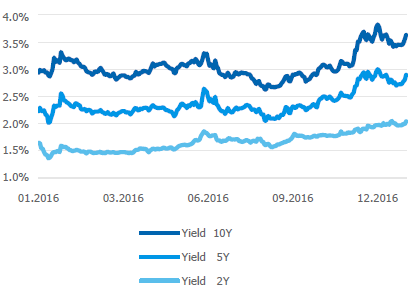

Polish 10-year treasury bonds also lost some of their value at the beginning of the year in connection with the increase in risk aversion on financial markets, as well as circumstances which were Poland-specific. These included, among others, a worse assessment of the fiscal outlook of Poland by the European Commission and the downgrading of the country by the rating agency Standard & Poor’s.

In that period in Poland, the interest rate market priced in a 25 bps reduction of the reference rate, which was driven, among others, by a very low rate of inflation and an accommodative monetary policy path communicated by major central banks.

The European Central Bank (ECB) eased monetary policy in March in reaction to the prolonged deflation and the risks to economic growth. A decision was made to increase the monthly scale of purchase of securities within the framework of the quantitative easing program, to expand purchases in order to include also non-bank corporate bonds and to extend the program until March 2017. The deposit rate and the refinancing rate of the ECB were reduced. Simultaneously, the ECB, as part of the quarterly TLTRO2 z , offered banks cheap and long-term loans whose interest rates depended on the involvement in the financing of the economy. This easing of the monetary policy was more far-reaching than it was expected by the market at that point.

Thanks to, among others, the decisive actions of the ECB, favorable macroeconomic data from the United States, and accommodative Fed rhetoric, there was an improvement in the financial market sentiment in March and an increase in risk appetite among investors. The downward prices trend on the Polish financial market was stopped. Besides global factors, the share prices received support from a very good reading of the economic growth in Poland for the fourth quarter of 2015.

The yields were supported by the reduction of the global uncertainty and the decline in the risk premium for Poland, which, however, continued to remain high.

However, the declines returned to the Polish market in early April. They were caused by the surprisingly low reading of Polish GDP dynamics in the first quarter of 2016 and the higher probability of Fed raising the interest rates in mid-2016. In Poland, the weakened valuation of big companies resulting from market and regulatory risks was particularly visible. This concerned mainly banks, retail chains, or raw material and energy companies. By the end of May 2016, WIG and WIG20 dropped below their level from the end of 2015.

In the last weeks of the first half of 2016, financial markets, especially in Europe, experienced the influence of the fear that the citizens of Great Britain would vote to exit from the European Union – the so-called Brexit. The share prices were

falling and there was high market volatility. The increased risk aversion on global markets produced increased variance of the Polish treasury bond yields. The slope of the Polish yield curve significantly flattened due to the upward shift of its short

end, which resulted from, among other things, a reduction in expectations of a possible interest rate cuts in Poland. The difference between yields of Polish and German 10-year treasury bonds remained for most of June at the level of more than 300 bps – such a persistent increase above this level occurred for the first time since the end of 2012.

When the people of Great Britain voted for Brexit, their decision was a big shock for stock markets. However, in the subsequent calm, indices made up for the losses in the third quarter of 2016. This resulted from the fact that the first

effects of Brexit turned out to be less severe than expected. Furthermore, the ECB and the Fed maintained lax monetary policy and, additionally, market expectations indicated its milder than previously assessed future course. The Polish broad market index, WIG, recorded in the third quarter of 2016 a considerable increase, but WIG20 index lost in value. This discrepancy can be explained by specific risks significant for large Polish stock market companies, for example financial or energy enterprises. Still, it should be noted that the August publication of a presidential draft of the act concerning the issue of mortgage loans in Swiss francs had a positive impact on the bank share prices, as it was received as lenient towards lenders.

In July and August, when the market calmed down after the Brexit shock, Polish 10-year treasury bonds gained in value, which was further supported by a short-lived increase in probability of another reduction of interest rates in Poland.

Later the Polish 10-year treasury bond yields returned to the path of growth, which was driven by, among other things, a gradual increase in yields in the USA.

The last several months of the year were heavily influenced by the US presidential election. Pre-election movements on the financial markets indicated that a potential victory of Donald Trump may result in an increase in risk aversion, a

decline in share prices, and the inflow of funds and assets to the countries considered to be „safe havens”. The election of Donald Trump as the US President came as a great surprise, but the reaction of financial markets to this election result

was even more unexpected. After initial weakening of the US dollar and decreases in stock indices in the US, markets soon returned to their starting points. This could have been a result of the first speech of Donald Trump in his new role as the

President-elect, which reflected the „mainstream” tone of the Republican Party. From then onwards, all price movements on global markets started to price in a so-called reflation scenario, which assumes a fiscal impulse in the US, leading to acceleration of economic growth and increase of inflation, and being at the same time conductive to the Fed raising interest rates and to the rise in US Treasury bonds yields. This scenario was made more probable when the Fed increased the

reference rate in December by 25 bps.

Under these circumstances, the increase in Polish treasury bond yields could have been largely a result of the increase in country risk premium, which was also connected with again in premium increase for emerging markets. It can be also

attributed to the phenomenon known as „repatriation” of capital, returning to the US.

The US presidential election was nevertheless not the only significant event. In December, the ECB decided to prolong the period of quantitative easing in the Euro zone. The ECB decision led to the yield curve steepening in Germany. On the one hand, the start of purchase of securities with yields lower than the ECB deposit rate and minimum maturities of 1 year resulted in a fall in yields at the short end of the yield curve. On the other hand, reduction of the total monthly volume of purchases lowered the prices of long-term securities.

Another important event was the Italian constitutional referendum which took place in early December. There was increased volatility and risk aversion on European markets before the referendum. However, its negative result did not have any serious negative market consequences. On the contrary, as it often happened with significant political events of 2016, the end of the period of uncertainty brought about a positive market rebound.

Ultimately, the WIG index rose by 11.4% and the WIG20 index increased by 4.8% in 2016.

As a result, stock markets entered a phase of substantial growth in the last months of the year. Ultimately, the WIG index rose by 11.4% and the WIG20 index increased by 4.8% in 2016. The Polish yield curve became significantly steeper. The yield of Polish one-year treasury securities remained almost unchanged, reaching level slightly lower than 1.45%. The yield of two-year treasury bonds increased by 40 bps, while the yields on 5- and 10-year bonds went up by about 60–70 bps. At the end of 2016, the 10-year treasury bonds yield amounted to about 3.60%.

According to the Ministry of Finance, the share of foreign investors in treasury bonds issued on the domestic market decreased from 39.5% at the end of 2015 to 32.8% at the end of 2016.

Treasury bond yields in 2016

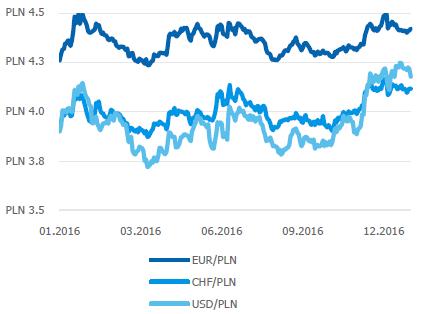

The foreign exchange market was highly volatile in 2016. It was not until September that the trend of a strong appreciation of the US dollar to the euro became noticeable. In the end, the EUR/USD exchange rate fell in 2016 by 2.9%. At the same time, the PLN weakened against major world currencies. Throughout 2016, the dollar exchange rate expressed in PLN grew by as much as 7.1% to 4.18 PLN, while the euro was worth about 4.42 PLN at the end of 2016 (up by 3.8%). The PLN weakened also in relation to the Swiss franc by 4.5% (the CHF/PLN exchange rate increased to about 4.12 PLN).

PLN exchange rate in 2016

2 TLTRO (targeted longer-term refinancing operations)